Chapter 2, titled “Growth: Illusions and Realities,” consists of 3 parts:

– Part 1 defines economic growth, and looks at the “very long run” – literally the past couple of thousand years. It ends with an intriguing question about what effect growth has on inequality.

– Part 2 looks at the past couple of centuries, looking at per capita productivity growth by sector, and what it implies, and asks if rapid economic growth is coming to an end.

– Part 3 looks at other aspects of growth, and focuses on the 20th Century as a possible anomaly.

Parts 2 and 3 will show up in 2 weeks or so.

Growth rates can be measured an terms of total output, population, and output per capita. Or, if you wish, size of the economy, number of people, and people’s incomes respectively. One good equation to keep in mind is that, measured as percentages:

(output per capita growth) + (population growth) = (total output growth)

(You can do algebra to solve for any one of these three variables. For example, total growth – pop. growth = output per capita growth)

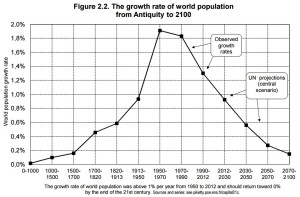

Chapter 2 starts off by pointing out that both population and income per capita growth between year zero and 1700 AD was, on average, extremely close to zero. (Thomas Malthus estimated 0.06% population growth and 0.02% per capita output growth.)

The reason is quite simple: higher growth rates would imply, implausibly, that the world’s population at the beginning of the Common Era was miniscule, or else that the standard of living was very substantially below commonly accepted levels of subsistence. For the same reason, growth in the centuries to come is likely to return to very low levels, at least insofar as the demographic ( = population ) component is concerned. (page 74)

One comment I have is that there were major booms and busts during those 17 centuries. Looking at Western Europe, both population and per-capita income fell considerably as the Roman Empire crumbled to barbarian invasions. Europe recovered a bit in the 1100s and 1200s, then imploded again with the arrival of the Black Plague in 1330. Growth started to accelerate again with the arrival of wealth and superior plants from the New World in the 1500s. But it’s true that these growth rates were all very modest by modern standards (though things could crumble quickly). On the other hand, my world history isn’t good enough to know if other parts of the world were doing equally bad in those same centuries. Probably not, so in that case world growth would be more steady than that of one region.

In general, population growth spikes upward, then slows down. Below is a more detailed table, showing that this happens on a regional basis.

Here’s an excellent video (albeit almost an hour long) showing much the same trend: population growth rapidly slowing in much of the developing world. The speaker, Hans Rosling, has many good videos on Youtube: search on “Gapminder Foundation.”

Finally, Thomas Piketty looks at economic growth as a factor for reducing inequality:

Other things being equal, strong demographic growth tends to play an equalizing role because it decreases the importance of inherited wealth: every generation must in some sense construct itself….Conversely, with low growth, moreover, it is fairly plausible that the rate of return on capital will be substantially higher than the growth rate, as situation that, as I noted in the introduction (to this book), is the main factor leading toward very substantial inequality…Capital-dominated societies in the past, with hierarchies largely determined by inherited wealth (a category that includes both traditional rural societies and the countries of 19th-Century Europe) can arise and subsist only in low-growth regimes. (Pages 83-84)

Thomas Piketty also points out that growth implies challenges, and opportunities, which just might allow clever people of lower means to do well. Conversely, a stagnant society can lock in a de facto caste system, with people’s lives locked in at birth.

Finally this section concludes with words of caution:

Growth may be help produce a more egalitarian society, but it is by no means sufficient to do so. “One sometimes hears the same thought expressed today that the new information economy will allow the most talented individuals to increase their productivity many tiems over. The plain fact is that this argument is often used to justify extreme inequalities and to defend the privileges of the winners without much consideration for the losers, much less for the facts, and without any real effort to verity whether this very convenient principle can actually explain the change we observe. (Page 85)

I’m not entirely convinced that high growth naturally decreases inequality, though I suppose if some accepts the converse than this naturally follows.

Twilight of the Elites by Chris Hayes is an excellent book that I read a few years ago. It’s important to note that “mobility” and “inequality” are two different things—a society could, in theory, be highly mobile but also highly unequal. Indeed, to this day high mobility is used to justify any level of inequality. (“I made it. You can too.” which of course, by definition, ignores the tautology that only 1% of people can be in the richest 1%.), though as his book notes, the wealthy will do their best to reduce social mobility, for example, by hiring private tutors for their children so that their children are much more likely to be admitted to elite universities, and social mobility is less in the United States than in much of Europe where inequality is less.