Chapter 3, titled “The Metamorphoses of Capital,” examines how the nature of wealth has changed over the past couple of centuries.

I broke the chapter into two parts, where part 1 focuses on private wealth, while the part 2 focuses mainly on public wealth and debt.

Thomas Piketty starts off by defining public wealth as falling into two categories: assets which are owned by the government and used by itself or the public (buildings, roads), and “financial” assets of the type that individuals also often own (for example, partial ownership in private corporations, or foreign assets). The line between these categories is blurry, as government-owned firms can be privatized. Similarly, it can be extremely difficult to precisely price a road or a park.

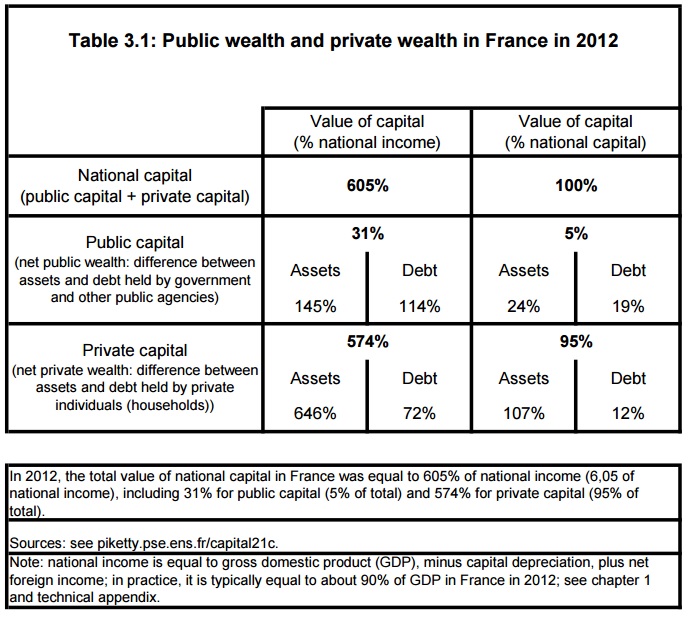

However, Thomas Piketty’s key point is that net public wealth (assets – debts) is very small compared with private wealth. “At present, the total value of public assets (both financial and non-financial) is estimated to be almost one year’s national income in Britain and a little less than 1.5 times that amount in France. Since the public debt of both countries amounts to about one year’s national income, net public wealth (or capital) is close to zero.” (page 124)

Since as the table above shows, net private wealth is almost 6 years national income, “Regardless of the imperfections of measurement, the crucial fact here is that private wealth in 2010 accounts for virtually all national wealth in both countries: more than 99% in Britain and roughly 95% in France, according to the latest available estimates. In any case, the true figure is greater than 90%.”