Review: Capital In the Twenty-First Century

by Thomas Piketty, 2014

Introduction to the book, part 1

The Introduction to Capital in the Twenty-First Century consists of four thematic, if not precisely designated, parts:

Part 1 is a very brief overview of what the book will cover, and chiding many in the debate for not using all data available.

Part 2 is overview of previous economists and “economic philosophers” who sought to study/explain changes in economic inequality, with an overall thesis that each of these analyses was (overly) influenced by the specific time it was written.

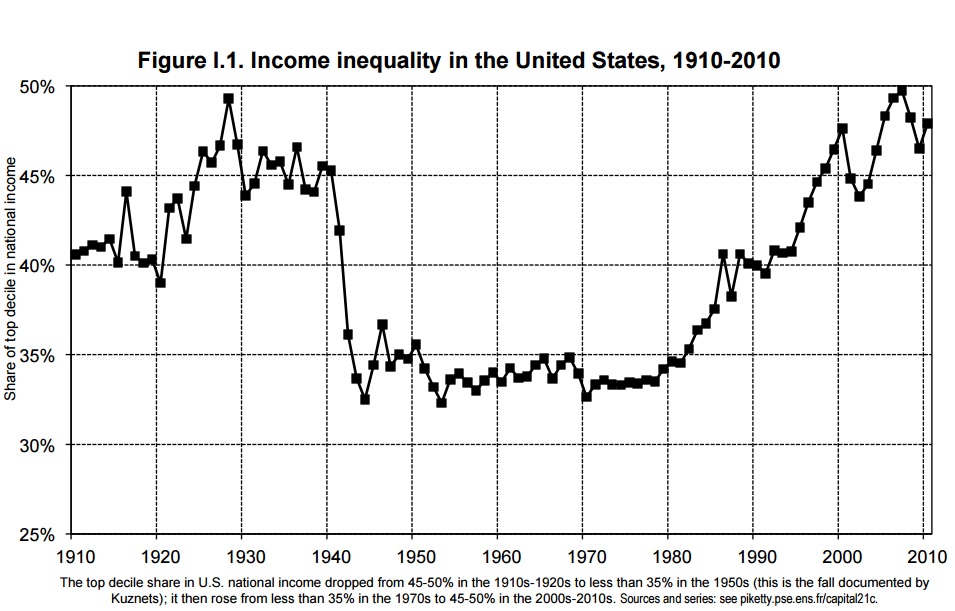

Part 3 defines and provides examples of “forces of convergence” and “forces of divergence” (or, as I call it in class, a stable equilibrium and an unstable equilibrium), where “convergence” means “shrinking inequality” and “divergence” means the opposite. A couple of time-series graphs are presented to show that we have been in a period of increasing inequality for over 40 years.

Part 4 is in overview on where he got his data, and explanations why he cites France so often (Thomas Piketty is French, but he gives non-patriotic reasons.), though he also looks extensively at the United States and only slightly less at other industrialized Northwestern European countries.

I’ll be posing reviews of each part at a rate of once/day, starting today with Part 1. Comments welcome!

Part 1:

The graph above is from the Intro of Capital in the Twenty-First Century. The pattern in the United States was fairly similar to that of other countries, featuring a U-shaped curve: high inequality in the early-20th Century, low inequality for a few decades after World War 2, then increasing inequality that put us more-or-less where we were 100 years ago.

“Without precisely defined sources, methods, and concepts, it is possible to see everything and its opposite. Some people believe that inequality is always increasing and that the world is by definition always becoming more unjust. Others believe that inequality is naturally decreasing, or that harmony comes about automatically, and that in any case nothing should be done that might risk disturbing this equilibrium. Given this dialogue of the deaf, in which each camp justifies its own intellectual laziness by pointing to the laziness of the other, there is a role for research that is at least systematic and methodical if not fully scientific.” (page 2-3)

The statement, from Part 1 rang really true to me. Last year I read The Rich Don’t Always Win – The Forgotten Triumph Over Plutocracy that Created the American Middle Class 1900 – 1970, by Sam Pizzigati, 2012. A book that looked at a similar topic, but a narrower focus (one country rather than many, 70 years rather than 200). The extremely sobering last chapter was reading about the broad-based wealthy, egalitarian state we had in this country that we let slip away. Sam Pizzigati quotes leftists and liberals of the 1960s and 70s who claimed that inequality had been rising during recent decades (not true) and that the high taxes on the wealthy therefore were ineffective (emphatically not true) and not worth defending, so that these high tax rates which had transformed American society were abandoned almost entirely without a fight.

Thus, the belief that either increasing or decreasing inequality (or, if you prefer, increasing or decreasing injustice) is automatic can be incredibly destructive.

For better or for worse, Politics is powerful, and we control our destiny.

Not from the book, but features another view of how the less-rich 90% in the United States have been doing progressively worse in each economic recovery since WW2. The most recent one continued the trend, but is the first time that income for the less-well-paid 90% fell during an economic recovery!

As a bonus for getting this far, here’s a link to a cartoon parody/review of Capital in the Twenty-First Century (“First Dog on the Moon Explains the Reaction to Thomas Piketty’s New Book,” copyright 2014 Guardian News & Media Ltd.)!

I read Capital in the Twenty First Century in 2014-2015 and was extremely impressed by both the content and the presentation. In my views, it’s easily in the running for most important economics book of the last few . This year I am doing an in-depth, chapter-by-chapter review of the book. One chapter will be reviewed and discussed every two weeks.

One Response to Capital in the 21st Century Review: Introduction (part 1 of 4)