Chapter 3, titled “The Metamorphoses of Capital,” examines how the nature of wealth has changed over the past couple of centuries.

I broke the chapter into two parts, where part 1 focuses on private wealth, while the part 2 focuses mainly on public wealth and debt.

Thomas Piketty starts off by defining public wealth as falling into two categories: assets which are owned by the government and used by itself or the public (buildings, roads), and “financial” assets of the type that individuals also often own (for example, partial ownership in private corporations, or foreign assets). The line between these categories is blurry, as government-owned firms can be privatized. Similarly, it can be extremely difficult to precisely price a road or a park.

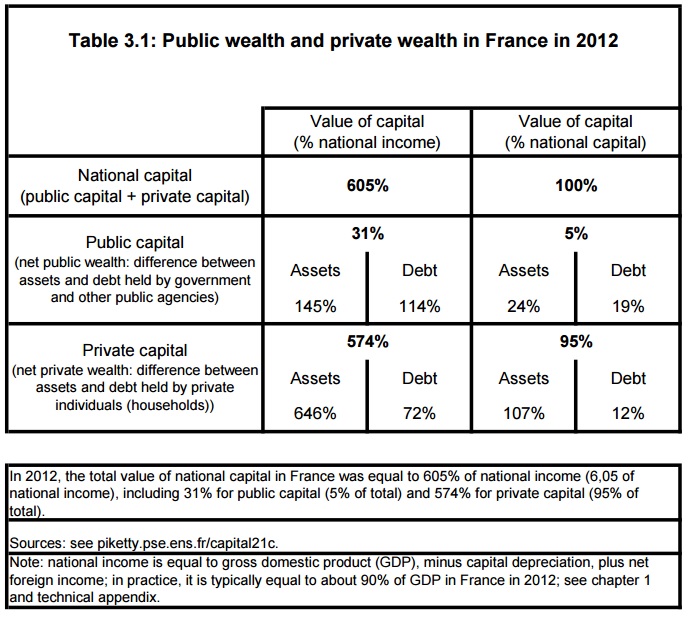

However, Thomas Piketty’s key point is that net public wealth (assets – debts) is very small compared with private wealth. “At present, the total value of public assets (both financial and non-financial) is estimated to be almost one year’s national income in Britain and a little less than 1.5 times that amount in France. Since the public debt of both countries amounts to about one year’s national income, net public wealth (or capital) is close to zero.” (page 124)

Since as the table above shows, net private wealth is almost 6 years national income, “Regardless of the imperfections of measurement, the crucial fact here is that private wealth in 2010 accounts for virtually all national wealth in both countries: more than 99% in Britain and roughly 95% in France, according to the latest available estimates. In any case, the true figure is greater than 90%.”

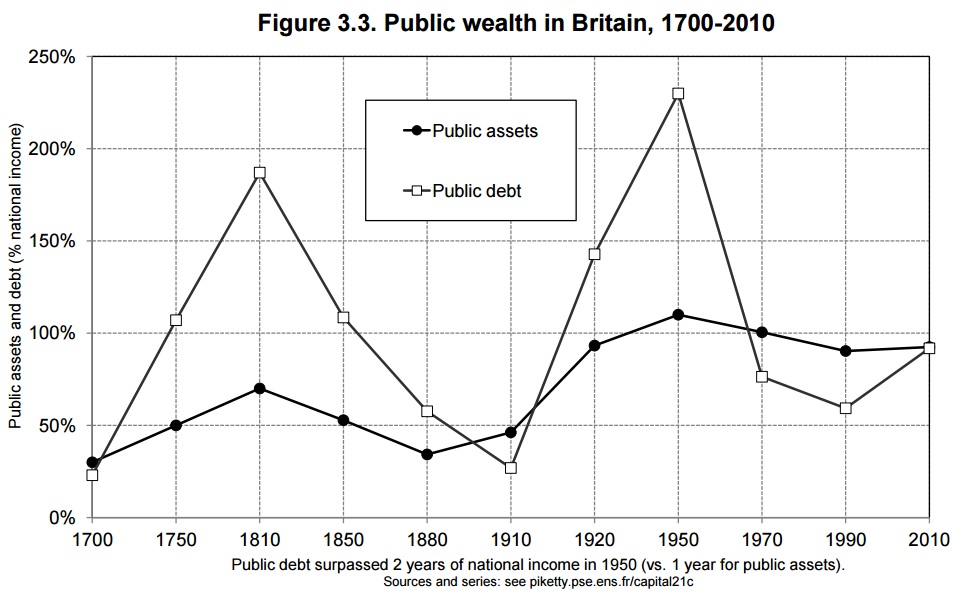

Thomas Piketty looks at British and French debt over the past few hundred years. I’ll focus on the British case, as it’s more extreme and clearer than that of the French, though they follow a similar pattern.

Britain took on enormous debt in the late 18th and early 19th Centuries, financing its wars (7 year war, American Revoluation, Napoleonic Wars) primarily through borrowing.

Although no country has sustained debt levels as high as Britain’s for a longer period of time, Britain never defaulted on its debt. Ineeed, the latter fact explain the former: if a country does not default in one way or another, either directly through simply repudiating its debt or indirectly through high inflation, it can take a very long time to pay off. (page 129)

It is quite clear that, all things considered, this very high level of public debt served the interests of the lenders and their descendants quite well, at least when compared with what would have happened if the British monarchy had financed its expenditures by making them pay taxes. (page 130)

The central fact–and the essential difference from the twentieth century–is that the compensation to those who lent to the government was quite high in the nineteenth century: inflation was virtually zero from 1815 to 1914, and the interest rate on government bonds was generally around 4-5 percent: in particular, it was significantly higher than the growth rate. Under such conditions, investing in public debt can be very good business for wealthy people and their heirs. (page 131)

The taxes-vs-borrowing tension has always existed. During World War 1, socialists criticized U.S. War Bonds, saying that the war should be funded through taxation. The distinction is quite simple: when a government borrows money from the wealthy, it gets the money now but pays them back with interest. Taxation means the government gets money right away, but does not have to pay anyone back. Note, however, that historically taxation doesn’t directly hit wealth (it is focused on income, plus the property tax, which only affects land a buildings and ignores other sources of wealth)–which is a larger figure than yearly income as we have seen–so unless that is done then borrowing gives the government access to more funds than taxation. One also could argue that borrowing in efficient, insofar as those with liquid assets are more likely to buy bonds while those whose assets are less liquid can hold off.

In the twentieth century, a totally different view of public debt emerged, based on the conviction that debt could serve as an instrument of policy aimed at raising public spending and redistributing wealth for the benefit of the least well off.The difference between (this and the former view of public debt helping the wealthy) is fairly simple: in the nineteenth century, lenders were handsomely reimbursed, thereby increasing private wealth; in the twentieth century, debt was drowned by inflation and repaid with money of decreasing value. (page 132)

Keynesianism, which I teach about in my economics class, reflects the 20th Century view of debt. I’d also add that it’s viewed as a way to increase economic stability. Beyond that, the logic of the above statement is quite self-evident.

The final bit of the chapter offers a good critique of “Ricardian equivalence” or the theory that public debt doesn’t affect national wealth if held by citizens of that country because the people literally owe it to themselves.

Since the 1970s, analyses of the public debt have suffered from the fact that economists have probably relied too much on so-called representative agent models, that is, models in which each agent is assumd to earn teh same income and to be endowed with the same amount of wealth (and thus to own the same quantity of government bonds). Such a simplification of reality can be useful at times in order to isolate logical relations that are difficult to analyze in more complex models. Yet by totally avoiding the issue of inequality in the distribution of wealth and income, these models often lead to extreme and unrealistic conclusions and there therefore source of confusion rather than clarity. In the case of public debt, representative agent models can lead to the conclusion that government debt is completely neutral, in regard not only to the total amount of national capital but also to the distribution of the fiscal burden. This…fails to take into account the fact that the bulk of public ebt is in practice owned by a minority of the population (as in nineteenth-century Britain but not only there), so that the debt is the vehicle of important internal redistributions when it is repaid as well as when it is not. (page 136)

Another reason debt matters, which Thomas Piketty does not go into here, is that there’s definitely an upper limit in how much tax revenue, at least tax revenue on income, governments can collect without making the economy function less efficiently as increased efforts are directed toward tax avoidance. In that sense, too high a public debt means that, after interest has been paid, there is less money for all the dynamic responses to challenges which governments need to rise to.

2 Responses to Capital in the 21st Century Review: Chapter 3 (part 2 of 2)